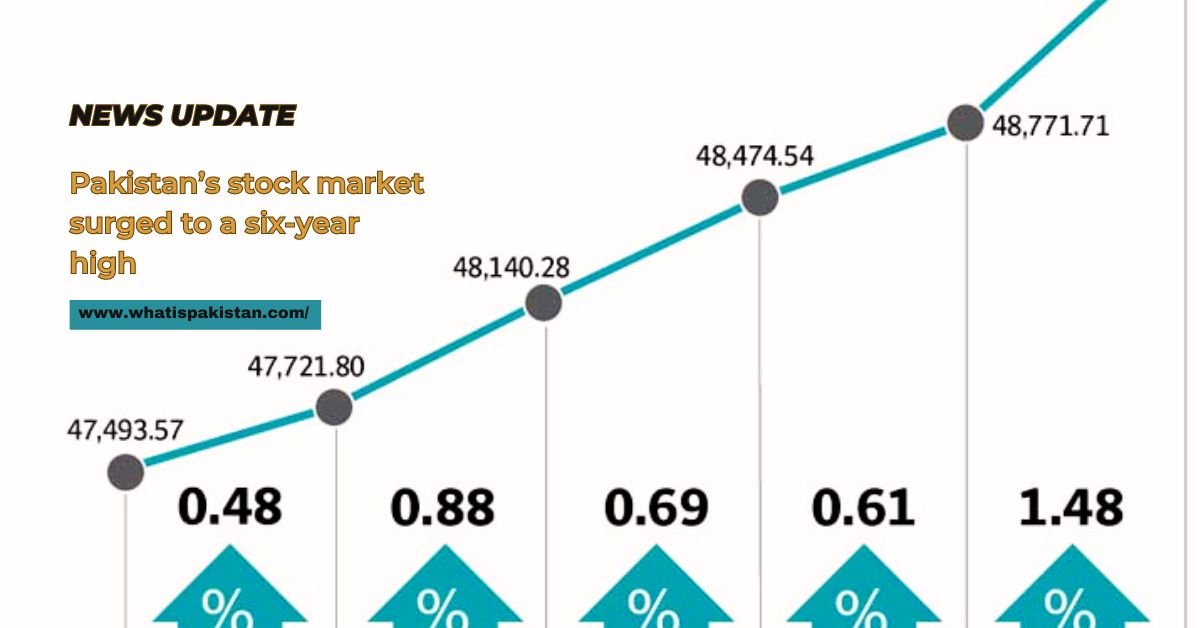

Pakistan’s stock market surged to a six-year high, Ranks Second in the World

In recent events, Pakistan’s stock market surged to a six-year high. Pakistan’s key stock index, the KSE-100, achieved this milestone on Friday, October 20, 2023. This feat positioned it as the second-best performer among the 90 global equity indexes monitored by Bloomberg. This month alone, the index recorded a nearly 10% increase, largely attributed to the hope that the strengthening rupee would alleviate inflationary concerns.

The rupee rebounded from its record low.

Pakistan’s currency, the rupee, has shown significant recovery, rebounding about 10% from its all-time low in September. This places it as the top-performing currency as per Bloomberg’s tracking. This surge in the currency’s value has instilled greater confidence among investors and the general consumer base.

The anticipation now is for decreased import costs and more affordable foreign debt repayments. This financial uptick can be credited to multiple factors, including heightened remittances from Pakistanis overseas, an influx of foreign direct investments, and a more favorable current account balance. To further ensure stability, the nation’s central bank also stepped in to stabilize the exchange rate, minimizing speculation.

The IMF Program Boosts Reforms:

Following the stock market’s impressive rally was the announcement of a provisional agreement with the International Monetary Fund (IMF) in June. This was regarding a loan program amounting to $3 billion, aimed at preventing Pakistan from defaulting. As defined by the IMF, Pakistan was tasked with implementing a series of reforms. These encompassed measures like increasing energy costs, slashing subsidies, broadening the tax net, and enhancing both fiscal and monetary strategies.

With the backing of the IMF program, Pakistan has witnessed an upswing in its macroeconomic markers, such as reducing its fiscal deficit, swelling its foreign exchange reserves, and trimming its public debt. The IMF also commended Pakistan’s strides in executing structural reforms, reflecting this with a commendatory review in September.

Challenges and Opportunities Ahead:

While the country is on an upward trajectory, it’s not without its share of challenges. Issues such as persistently high inflation, limited foreign exchange reserves, and looming political instability, especially with the national elections on the horizon for late January 2024, remain. Moreover, the recent spike in global oil prices, a direct consequence of the Israel-Hamas conflict, might jeopardize Pakistan’s economic stability.

Yet, in light of these adversities, several analysts and investors remain bullish about the prospects of Pakistan’s stock market. Their optimism stems from the market’s undervalued nature, the successful IMF assessment, and the continually improving macroeconomic markers. There’s also the expectation that the impending elections will usher in a more stable political and economic climate.

Conclusion:

Pakistan’s stock market surged to a six-year high. A Testament to Economic Resilience: Throughout its trials and tribulations, Pakistan’s stock market has demonstrated undeniable resilience, growing exponentially even when faced with challenges. Its recent surge to a six-year high is a testament to its position as one of the most enticing emerging markets globally, often outshining many of its counterparts. The future of Pakistan’s economy hinges on its capability to sustain this reformative momentum and navigate the challenges that lie ahead.

Also read: SBP confirms the safety of deposits above Rs 500,000.