FBR Wants More Tax From Non-Filers [ Full detail]

Did you know FBR Wants More Tax From Non-Filers? The revenue shortfall in October 2022 was Rs. 22 billion, thus the Federal Board of Revenue (FBR) decided to adopt policy and enforcement measures totaling Rs. 60 billion, including additional taxes from non-filers.

The FBR is not currently developing any new tax policies; nonetheless, some taxation provisions included in the Finance Act of 2022 have not yet been fully implemented and enforced.

Player Close ALSO READ FBR Sets Tax Collection Target of Rs. 537 Billion for November It has been determined to strictly implement the large measures adopted under the Finance Act 2022 against the non-filers.

When exchange companies and banks strictly enforced these rules, revenues grew. In October 2022, the FBR only brought in Rs. 512 billion, despite having aimed for Rs. 534 billion. If the FBR doesn’t reach its goal by the end of November, then immediate action will be done.

The FBR needs an increase in tax collections of 21.5% from the previous fiscal year in order to reach its yearly target of Rs. 7,470 billion for 2022-23. Not long ago, FBR Chairman Asim Ahmad issued an order to the Chief Commissioners of Inland Revenue in Karachi mandating that banks withhold higher rates of tax from customers who are not on the Active Taxpayers List (ATL).

Every financial institution in Pakistan is required by the Finance Act 2022 to collect this variable advance tax from customers who use credit, debit, or prepaid cards to make purchases from merchants located outside of Pakistan before sending the proceeds of the transaction abroad. FBR Wants More Tax From Non-Filers.

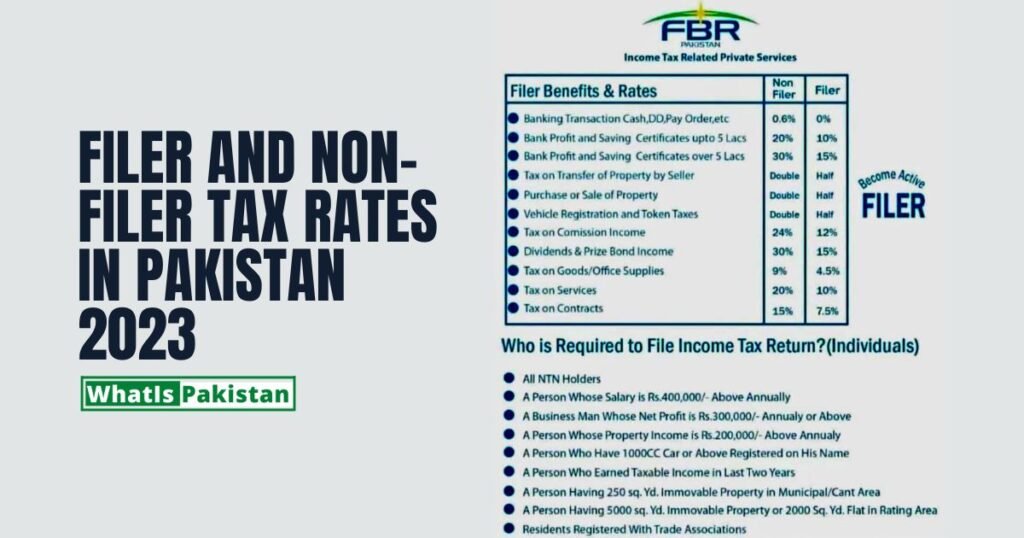

Filer and non-filer tax rates in Pakistan 2023

For corporations, the tax rate is 8% for those who file an income tax return and 16% for those who do not. The tax rate is 10% for individuals who file an income tax return and 20% for those who are not included on the ATL in all circumstances except those involving corporations.

The government has committed to the International Monetary Fund

The government has committed to the International Monetary Fund (IMF) to take contingency measures at the earliest signs of fiscal program underperformance.

- Increase the GST on gasoline by 17 percent immediately, as a stepping stone to the full rate;

- Exemptions for sugary drinks (Rs. 60 billion) and other unjustified exemptions, such as those favoring exporters, should be streamlined further.

- We need to generate at least Rs. 120 billion more quickly, thus we’re raising the Federal Excise Duty on Tier I and Tier II cigarettes by at least Rs.

conclusion

I hope you have gained something from the above FBR information and have also found this information good. Thank you for reading this information.

![Pakistan Names a New Army Chief [in 2023 full detail]](https://whatispakistan.com/wp-content/uploads/2022/11/Pakistan-Names-a-New-Army-Chief-in-2023-full-detail-1-768x403.jpg)

![Toyota Unveils Slightly Less Ugly C-HR Concept In 2023 [Full Details]](https://whatispakistan.com/wp-content/uploads/2022/12/Toyota-Unveils-Slightly-Less-Ugly-C-HR-Concept--768x403.jpg)